The year 2024 was a milestone year for OTP banka and OTP Group Slovenia, marked by the successful completion of one of the largest bank mergers in the region. By increasing its core revenue streams, OTP Group Slovenia achieved solid financial performance, establishing itself as one of the leading banking group in Slovenia and a vital member of OTP Group, the fastest growing and stable banking group in Central and Eastern Europe (CEE).

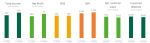

OTP Group Slovenia - key performance indicators for 2024:

Despite challenging business conditions, marked by low economic growth and falling interest rates, OTP Group Slovenia performed robustly in 2024. The Group concluded the year with a net profit of €311.4 million (2023: €280.3 million), with OTP banka generating a net profit of €309.4 million (2023: €272.2 million). Return on Equity (ROE) after taxation for 2024 was 17.93% at Group level and 17.86% at Bank level.

Net interest income for the Group amounted to €494.2 million in FY 2024, an increase of 3.8% compared to FY 2023, while OTP banka’s net interest income amounted to €480.6 million. The net interest margin of the Group rose to 3.31% in FY 2024, compared with 3.18% in FY 2023.

A Landmark Merger in Slovenia’s Banking Sector

2024 was marked by several major achievements, from which the most important was the merger of Nova KBM and SKB banka, both members of OTP Group. The merged OTP banka consolidated its position as the most accessible bank in the country and one of its principal financial institutions, maintaining a leading position in the Slovenian market in terms of the share of loans and deposits.

Following the merger, our clients have benefited from the largest physical network of banking points consisting of over 900 branch offices, ATMs and Post Offices across Slovenia. In addition, since the beginning of 2024, clients of both banks have been able to make free cash withdrawals with a Visa debit card at more than 4,000 ATMs of most members of OTP Group, both in Slovenia and abroad.

One of the biggest bank mergers in the history of Slovenia also resulted in the formation of a new banking group – OTP Group Slovenia – which complements banking services with the leasing and factoring services provided by subsidiaries SKB Leasing, SKB Leasing Select and OTP faktoring (previously Aleja finance).

Brand Growth and Increased Recognition

OTP banka’s brand awareness in Slovenia is growing rapidly, thanks to the successful integration of IT and business processes and the rebranding of all banking touchpoints with the new OTP banka logo. Supported the communication campaign “We are here” (for you), OTP banka stregthenes its brand positioning, both in Slovenia and the wider region.

The successful merger would not have been possible without the collaboration and dedication of our employees, who were part of the integration team. The integration into a unified team continues with the creation of a new culture guided by the shared values of

OTP banka: customer focus, trust and integrity, collaboration, continuous development and excellence.

Other major achievements

At the beginning of 2024 ex Nova KBM participated in the issue of a Republic of Slovenia bond for citizens and supported subscriptions. In March 2024, the bank completed a successful €300 million bond sale, attracting a large number of investors and resulting in the largest order book for a Slovenian financial institution in history and the largest in the CEE region in recent years.

We listened to the needs and wishes of our customers by enabling contactless payments with Google Pay, Apple Pay and Garmin Pay. We continued to enhance our modern digital channels to ensure the best possible user experience and expanded our range of bundled products with the new Ekstra bundle for those seeking even more convenient banking.

Commitment to Sustainability

Through profitable operations, OTP banka and OTP Group Slovenia have ensured a solid foundation for long-term sustainability and resilience, as well as further investments in development and socially responsible practices. We continued to implement a comprehensive ESG strategy focused on enhancing sustainability to strengthen our competitiveness and appeal. With this strategy, we aim to systematically manage environmental and social aspects while maintaining high standards of corporate governance, setting the best example both in banking and in our collaboration with customers.

As part of our sustainability efforts, OTP banka earned the four-star Green Star certificate, and become a signatory of the UN Principles for Responsible Banking. These achievements position the bank as a leader in sustainable banking in the region.

OTP banka received the “TOP investor in training” certificate for systematic and long-term investment in developing the knowledge and skills of its employees which the bank sees as the key for the success both of the individual and of the organisation as a whole.

OTP banka continues to be a key supporter of numerous socially responsible projects in various fields. It remains the main sponsor of the Slovenian Olympic Committee, extending an exceptional partnership that began more than 30 years ago into the 2024–2028 Olympic cycle, with the highest level of financial support to date. We are also continuing our excellent collaboration with champion cyclist Primož Roglič, an OTP banka ambassador, with whom we traditionally organise the high-profile charity event Golden Circle.

International recognition

OTP banka has been named the Best Bank in Slovenia for 2025 by Global Finance while OTP Group has been recognised as the Best Bank in Central and Eastern Europe. OTP Group’s recognition externds beyond Slovenia, with awards also to its subsidiaries in Hungary, Croatia, and Montenegro. This acknowledgment reflects OTP Group's exceptional financial performance, strategic initiatives, sustainability and innovation across the region.

Spyridon Ntallas, President of the Managament Board of OTP banka: “With last year’s merger, OTP banka became one of Slovenia’s leading banks. Our ambition, however, is not only to lead, but to redefine banking excellence and set new standards in the industry. We place customers at the forefront of everything we do and provide them with top-quality services and the widest accessibility. This merger has also been a historic milestone for our owner, whose support and expertise have been invaluable. We are proud to be a key member of OTP Group and to have already established ourselves as one of the most successful banks in the Group”.

Imre Bertalan, Chairman of the Supervisory Board of OTP banka: “With the merger, OTP banka became one of the largest and most successful members of OTP Group, positioning itself to participate in major projects across Slovenia and support the growth of medium-sized and large enterprises in the region. OTP Group Slovenia now has the scale and resources to strengthen synergies within the Group and serve as a reliable partner for businesses across Central and Eastern Europe.”

OTP Group – A Story of Growth, Resilience and Stability

OTP banka is part of OTP Group, one of the fastest growing and most stable banking groups in Central and Eastern Europe. In 2024, OTP Group reported a profit of €2.72 billion, marking a 9% annual growth, with an ROE of 23.5%. The Group’s foreign profit contribution reached 68%, underscoring its significant international presence. Additionally, OTP Group achieved the 4th best result in the EBA stress test and was recognized as a top performer among Europe’s 50 largest publicly listed banks (S&P Global Market Intelligence).

The change can usually be made in the browser menu Tools > Internet options, under “Privacy” or “Security” tab. There you can specify which cookies to block and which to enable.

Cookies can also be deleted through the browser. Most browsers provide this option under "Clear browsing data" or "Clear browsing history" (the keyboard shortcut is usually CTRL+Shift+Del), where you select the clear cookies option.

Some browsers include the "Do-not-track" option that allows you to reject cookies in general.

You can change your decision about rejecting the cookies that are used at www.otpbanka.si to improve user experience here: